How to Apply for MBNA Rewards World Elite Mastercard Credit Card

Unlock the benefits of the MBNA Rewards World Elite Mastercard, featuring a generous points system, comprehensive travel insurance, and no foreign transaction fees. Enjoy exclusive discounts and partner offers for enhanced savings. Maximize your rewards by using your card strategically for high-earning categories and international purchases.

How to Apply for National Bank Personal Loans Easy Steps Guide

National Bank Personal Loans offer flexible borrowing, competitive interest rates, and a straightforward approval process. Enjoy fixed monthly payments to manage your finances easily. Ideal for diverse needs like home renovations or debt consolidation, these loans provide the financial freedom to reach your personal goals effortlessly.

How to Apply for MBNA True Line Gold Mastercard Credit Card Today

The MBNA True Line Gold Mastercard offers a low interest rate, no annual fee, and robust fraud protection, making it a budget-friendly choice. Enjoy exclusive access to events and experiences, while benefiting from comprehensive security features. Perfect for saving money and enhancing your lifestyle effortlessly.

Apply for MBNA Smart Cash Platinum Plus Mastercard Credit Card Easily

The MBNA Smart Cash Platinum Plus Mastercard offers up to 2% cash back on groceries and gas, no annual fee, and extended warranty protection for purchases. Enjoy flexible payment options to manage your finances effortlessly, making it an excellent choice for budget-conscious individuals seeking rewarding benefits.

How to Apply for AMEX American Express Aeroplan Reserve Card Today

The AMEX American Express Aeroplan Reserve Card offers comprehensive travel insurance, robust Aeroplan points for everyday spending, priority airport services, and a generous welcome bonus. Additionally, cardholders gain exclusive access to events and enjoy enhanced travel experiences, making it a valuable choice for frequent travelers.

Easy Steps to Apply for a National Bank Syncro Mastercard Credit Card

The National Bank Syncro Mastercard offers a low interest rate ideal for reducing debt, comprehensive purchase protection against theft or damage, and extends manufacturers' warranties, providing extra security. It's perfect for significant or big-ticket purchases, maximizing savings, and ensuring peace of mind.

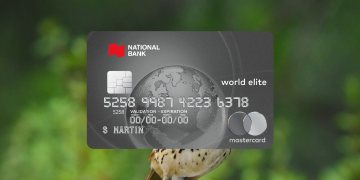

How to Apply for National Bank World Elite Mastercard Credit Card Easily

The National Bank World Elite Mastercard offers rewarding travel points, comprehensive travel insurance, and Priority Pass lounge access. Enjoy flexible payment options, including alerts and balance transfers, and benefit from a 24/7 concierge service for bookings and recommendations, enhancing your travel and financial control.

How to Apply for the National Bank Platinum Mastercard Credit Card

Unlock the benefits of the National Bank Platinum Mastercard Credit Card: enjoy comprehensive travel insurance, earn redeemable reward points on every purchase, benefit from extended warranties and purchase protection, and access exclusive discounts. Experience greater value and peace of mind for both everyday spending and special occasions.

How to Apply for the NEO Credit Card Easy Guide Benefits

The NEO Credit Card offers up to 5% cash back at thousands of Canadian retailers, no annual fees, and flexible payment options. Enjoy enhanced security with real-time notifications and simple online management to track spending and rewards. Maximize savings and streamline finances with this cost-effective card.

How to Apply for the AMEX Business Platinum Card from American Express

The AMEX Business Platinum Card offers substantial reward points on purchases, especially on travel expenses, along with comprehensive travel benefits, including lounge access and concierge services. Enjoy exclusive events, purchase protection, and extended warranties, making it an ideal choice for Canadian businesses seeking convenience and value in their transactions.